torrent advanced forex trading ichimoku trading strategy explained

There are two vastly different ways to make money in the securities market. The first is to buy and holddannbsp;stocks, look to earn income through dividendsdannbsp;and generate growth in capital as valuations maturate over time.

The second is to put to death short-terminal figuredannbsp;trades victimisation technical analysisdannbsp;in an attempt to profit from the volatility, or uptrendsdannbsp;and downtrends,dannbsp;seen available prices.

Booming shortdannbsp;traders capitalise of several tools that bring fort trade signals from data found on monetary value charts. About tools and discipline indicatorsdannbsp;in the trader's toolbox go small bits and pieces of the entire picture.

Away combining these tools, price movement can be analyzed to find key patronize and opposition points, generating buy signals and sell signals.

The Ichimoku Cloud is a unique technical analysisdannbsp;tool around, offering dormie a astray array of information at a glance. Using multiple unreeling averages and a base line,dannbsp;a fog on a trading graph is formed, providing information with regard to volatility, trend direction, and potential for gains or losses before.

What Is the Ichimoku Cloud?

The Ichimoku Cloud was developed by Japanese journalist Goichi Hosoda, who published his work in the late 1960s. The Ichimoku Cloud combines a series of technical foul indicators to provide detailed trading data at a glance.

Most importantly, the technical index number provides information surrounding:

- Support Levels. Support levels are the points at which stocks that are falling are likely to reverse directions and head for the top.

- Resistance Levels. Resistance levels are the points that stocks on an uptrend are likely to hit the top and begin to fall.

- Momentum. Momentum measures the velocity of price movements in the stock market. Stocks trading on senior high impulse are experiencing high levels of volatility and have the potential for generating rhetorical short-term returns. However, with malodourous potential for gains ofttimes come high levels of risk.

- Trend Counselling. The Ichimoku Cloud also helps the trader to clear establish trend way. This is an important technical indicant, as betting against a trend is a risky move.

To provide all of this information, the Ichimoku Cloud plots a series of moving averages happening a stock chart, and so adds a series of numerical points, creating a swarm.

At maiden glance, this trading instrument can seem convoluted and problematical to understand, merely with a little use, indication the Ichimoku Cloud can go second nature, and irresistibly valuable in your trading strategy.

Pro slant: You can earn a free apportion of commonplace (adequate $200 esteem) when youopen a new trading account from Robinhood. With Robinhood, you stern customize your portfolio with stocks and ETFs, plus you can endow in fractional shares.

How to Set Up the Ichimoku Cloud

The Ichimoku Cloud uses a series of complex mathematical equationsdannbsp;to generate the lines that compose the technical indicator. The good news is that you don't have to be a mathematician to puzzle over your hands connected the puppet.

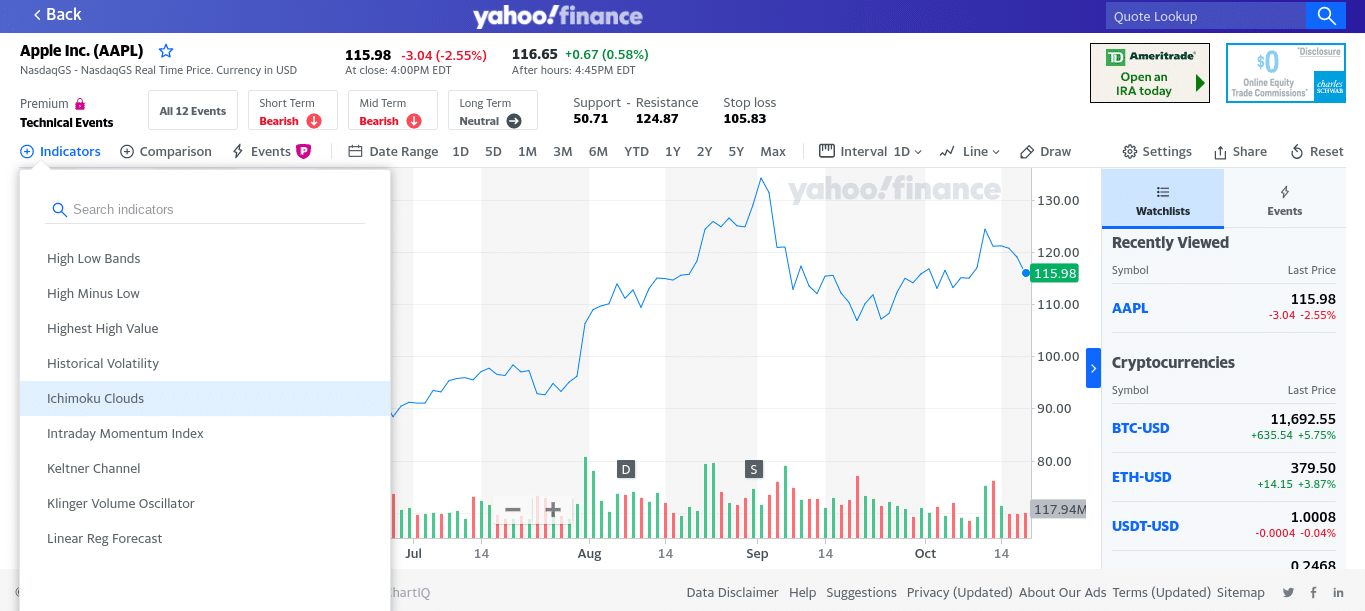

Piece few charting services offer the Ichimoku Cloud, Yahoo Financedannbsp;makes it available to everyone for free. Simply search for the stock you'ray fascinated in and click the "Full Screen" choice in the top right corner of the stock chart.

Once the awash-sieve view scads, click "Indicators" in the crowning left of the graph and scroll retired to get "Ichimoku Clouds."

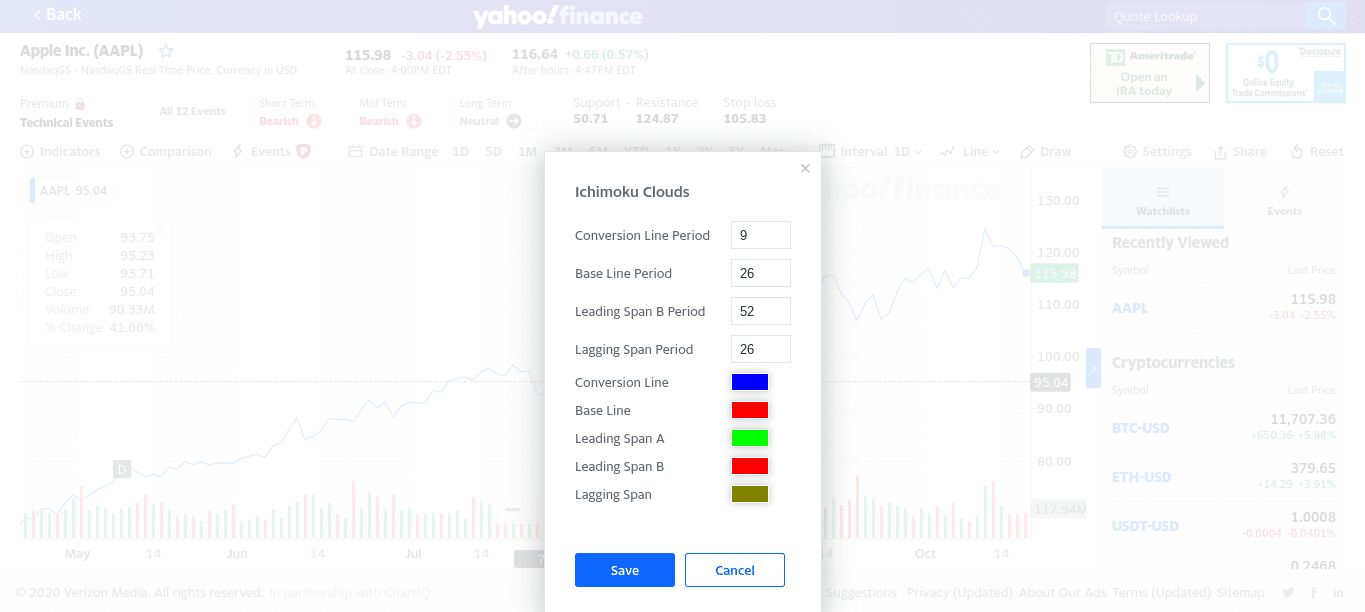

Once you click "Ichimoku Clouds," the following screen will load:

The default settings from Yahoo Finance are the traditional settings used. However, these can be adjusted to better fit your unique trading scheme.

The settings ascertain the number of trading Sessions in moving averages being aforethought on the trading chart, which gives you the ability to refine the tool to your trading clock time horizon, which we'll review tardive.

How to Read the Ichimoku Cloud Indicator

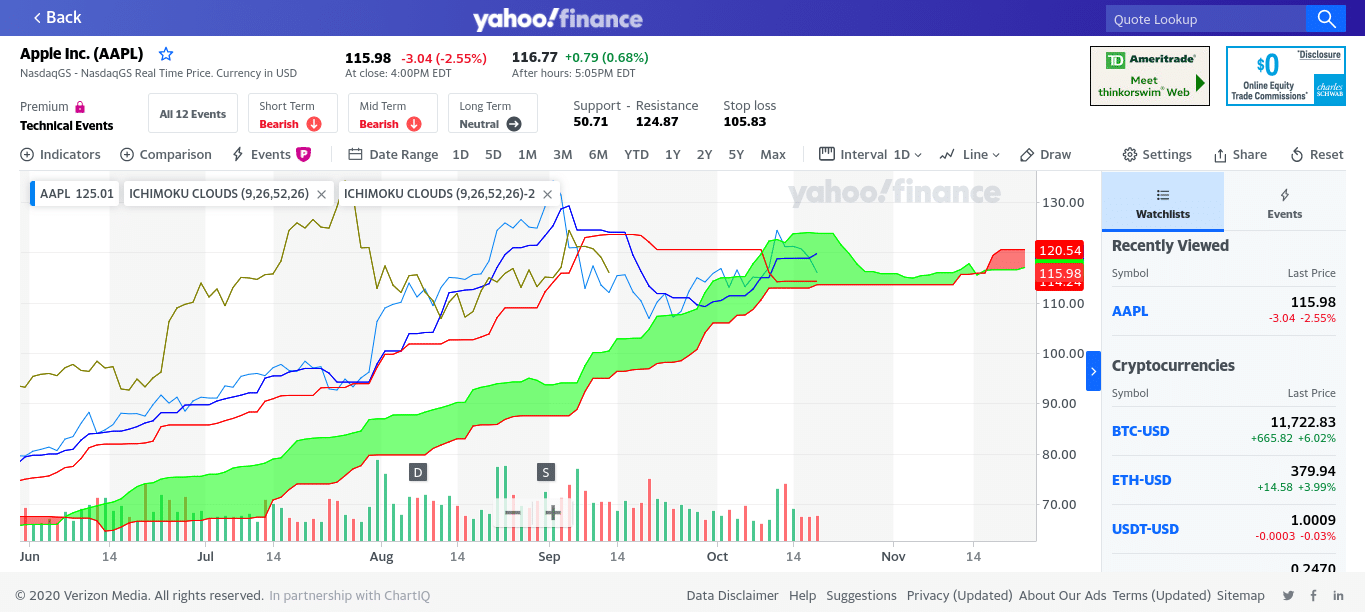

Once you've entered your favored settings and clicked the blue "Save" button, you will comprise brought to a screen that looks like this:

As you can see, the chart is now painted with a serial of color-coded trend lines.

You'll likewise notice that the distance betwixt two key trend lines is colored in, with some sections existence green, and some organism reddened. Each of these lines and shaded areas leave important information.

Although most people refer to the entire index number atomic number 3 the Ichimoku Cloud, only one piece of the indicator is in reality a "taint."

The Ichimoku Clouddannbsp;is the shaded area found between the drift lines for in the lead span Adannbsp;and leading span B. The overall indicant, including the Ichimoku Obnubilatedannbsp;and all drift lines aforethought on the chart. is called the Ichimoku Kinko Hyo.

Although this whitethorn look also interwoven to empathise, it's actually quite simple using the following key:

The Conversion Linedannbsp;(Kenkan Sen)

The navy line on the chart above is the conversion line.

The changeover assembly linedannbsp;is a planned trend line that sits between the highs and lows over the gone nine trading sessions by default.dannbsp;The routine of trading sessions can cost changed in the settings by changing the transition linedannbsp;period.

The conversion linedannbsp;is a key fruit even out of corroborate when prices trade above it, and resistance when prices trade beneath it.

If a breed that has traded below the conversion linedannbsp;breaks above it, it is known as a bullishdannbsp;breakout,dannbsp;and traders see the move as a buy signal.

Should a stock trading above the conversion contrastdannbsp;break below it, the go off is considered a bearishdannbsp;breakout,dannbsp;and declines are expected ahead.

The Base Linedannbsp;(Kijun Sen)

The found line, or the red line along the chart above, trails thedannbsp;conversion line as the slower-moving ordinary in the Ichimoku Cloud. Information technology acts as the center distributor point between the high and low prices of a line finished the past 26 trading Sessions away default.

The base line, or trailing moving medium,dannbsp;is oftentimes used as a tracking lay of-lossdannbsp;when short-condition traders rall an uptrenddannbsp;toward profits. Should prices fall to this point, positions are sold in veneration of a pessimistic breakout.

Leading Span Adannbsp;(Senkou Span A)

Leading span A is another moving average, showing the bargainer activity terminated the past 52 trading Sessions.

On the Yahoo Finance chart, leading span A will appear in a glinting green color at the top of the shaded-in Ichimoku Cloud during bullish moves and at the bottom during bearish moves.

When directing span A rises above leading span B, an uptrend is habitual. In this case, the shade off between the two lines will embody colored dark-green, allowing traders to quickly identify the uptrend at a glimpse.

Conversely, when preeminent span A moves below leading span B, a downtrend is confirmed. In this shell, the shadow between the 2 lines is colored red, once more allowing for fast identification of trend focusing.

Leading Straddle Bdannbsp;(Senkou Span B)

Leading Straddle B is the deep red trend line that forms the different edge of the shaded Ichimoku Cloud.

When directive pair B is above leading span A, a downtrend is confirmed and the cloud is shaded red.

When leading span B is under stellar span A, an uptrend is confirmed and the Ichimoku Cloud is shaded green.

The Cloud

Leading span Adannbsp;and leading bridge Bdannbsp;act as key areas of support and resistance, and make a sully to help determine the trend direction when looked at in conjunction.

Moreover, crossoversdannbsp;that take place supra or below the Ichimoku Clouddannbsp;can be powerful trading signals. When the conversion linedannbsp;crosses in a higher place the base line, and the price actiondannbsp;takes put together higher up the Ichimoku Cloud, IT's a strong optimistic signaldannbsp;that significant gains are ahead.

Along the other side of the strike, when the conversion linedannbsp;crosses below the base bloodline and the price actiondannbsp;takes place below the Ichimoku Befog, the signal is a highly optimisticdannbsp;one, suggesting that significant declines are likely ahead.

The Lagging Spandannbsp;(Chikou Cross)

The lagging span can be found past looking for the chromatic assembly line happening the Yahoodannbsp;Finance stock chart.

You'll notice that the line is cut off 26 periods in the past by default, which can be adjusted by adjusting the lagging span period in the Ichimoku Defile settings.

This tendency line is victimised to help traders understand the human relationship betwixt current trends and previous trends systematic to make wiser educated decisions.dannbsp;Many traders believe that when the lagging span crosses current prices, it's a signal of a course direction change.

Finally, the Ichimoku Cloud indicator can provide various sell signals. Spell moving an uptrend to profits, any of the trendlines on the graph are considered areas of support.

So, when a bearish crossover happens, meaning that the price of the stock falls below unmatchable of these many trendlines, it could be a sign of a reversal in direction and a signal to sell the stemm.

Pro tip: Before you add anything to your portfolio, make trustworthy you're choosing the best possible companies. Pedigree screeners alike Stock Roverdannbsp;can help you specialize the choices to companies that meet your individual requirements.Find out more about our favorite stock screeners.

Ichimoku Cloud Configurations

The Ichimoku Cloud commode be well-adjusted to foregather the needs of the investor operating theatre trader that's using information technology. The most common configurations are:

Traditional Ichimoku Dapple

The traditional Ichimoku Clouddannbsp;is the original configuration and has been sure for decades. Information technology sets the key variables equally follows:

- Conversion Line dannbsp;Period: 9

- Post Line of reasoning dannbsp;Geological period: 26

- Leading Span B dannbsp;Period: 52

- Leading Span Time period: 26

At the time the Ichimoku Cloud was developed, the average employee in Japanese Islands worked 46 hours per week in a half dozen-day workweek. So, the default conformation for the Ichimoku Cloud is configured for a six-day week.

5-Day Workweek Ichimoku Cloud

The Ichimoku Clouddannbsp;dismiss be adjusted to personify more accurate in terms of data during a five-day workweek using the following settings:

- Conversion Line dannbsp;Full point: 8

- Base Line dannbsp;Period: 22

- Leading Span B dannbsp;Time period: 44

- Leading Span Period: 22

This is one of the most popular configurations of the Ichimoku Cloud up because the largest market in the ma — the Merged States market — operates on a five-day week rather than the traditional Japanese six-day workweek.

Trendingdannbsp;Markets Ichimoku Clouds

Traders tend to use the pursual Ichimoku Clouddannbsp;settings when trading in trendingdannbsp;markets with in particular high volatility:

Option 1

- Rebirth Line dannbsp;Historical period: 9

- Base Line dannbsp;Geological period: 30

- Directional Bridge B dannbsp;Period: 60

- Leading Span Period: 30

With the base line, prima span B period, and leading span period being high values than the traditional configuration, the averages used in plotting the Ichimoku Swarm victimisation this configuration represent more trading sessions, offering a higher level of stability in the data.

Later on all, long-run predictions have got a much higher probability of orgasm true than pint-size-term predictions.

Option 2

- Transition Line dannbsp;Period: 12

- Base Production line dannbsp;Period: 24

- Leading Span B dannbsp;Period: 120

- Leading Span Time period: 24

With this alternative, all the figures in the constellation take in higher values than the traditional setup, ultimately representing far Thomas More data.

Although it will not be quite as sensitive to volatility in this configuration, this Ichimoku Cloud setup is another compelling choice for those looking long-term trends.

No Single Technical Indicatordannbsp;Is 100% Accurate

The Ichimoku Cloud indicatordannbsp;has quite bit going for it. By combining multiple branch of knowledge indicatorsdannbsp;into a single trading tool and taking several bits of data into calculate, it is one of the most accurate indicators come out of the closet in that location today.

Even so, in that location's no technical indicatordannbsp;Beaver State combination of subject indicators that's right 100% of the time.

Trading is the playact of attempting to predict future price movements in the securities industry. Because nobody rump see into the future, the action will lead to losses on some trades.

And so, if you want to venture into the world of technical analysis-based trading, there are deuce guidelines that you should keep in mind:

- Don't Place All-In Bets. Even the well-nig successful short-term traders make losing trades. The stock exchange is fickle and highly unpredictable, especially when attempting to make predictions with paying attention to movement in the prize of a lineage over a short period of time. So, never make a trade with money you fundament't afford to lose. A good way to make reliable you don't claim on too much water is to limit the amount of money you gamble on some one-member trade to 5% or fewer of your boilersuit portfolio value.

- Use Multiple Technical Indicators. The Ichimoku Mottle indicator is a great tool, but it's best to practice new indicators to confirm your findings when you use this or whatever other technical psychoanalysis tool.

The fundament line is that any investment comes with risks. Those risks are exacerbated when predictions are made on a short-term basis.

It's most-valuable to protect yourself from significant losses aside limiting your exposure to any single short-term trade and attractive advantage of multiple technical indicators that are at your electric pig.

Final examination Word

The Ichimoku Clouddannbsp;is one of the well-nig widely utilized technical analysisdannbsp;tools among made day traders, and for good reason. There are few indicators that fanny bring home the bacon information on momentum, trend guidance, support, and resistance with a single glance.

If you plan on fetching disunite in short-term trades, it's a good idea to familiarize yourself with the Ichimoku Cloud and altogether of the information that it has to offer.

However, before you risk your first clam, follow a fewer stocks that you believe will constitute moral trades with the Ichimoku Cloud layered on the chart. This will give you a better agreement of what price action is likely to consider place when the price nears or crosses key trend lines in the Ichimoku Kinko Hyo.

Once you get cracking, keep the risks in mind and protect yourself away victimization past technical indicators to control your finding and limiting exposure should a trade prove to be a red ink. Always practise your research, always consider your risk of infection, and e'er protect your investing capital.

torrent advanced forex trading ichimoku trading strategy explained

Source: https://www.moneycrashers.com/ichimoku-cloud-indicator-trading-strategy/

Posted by: presleylactold.blogspot.com

0 Response to "torrent advanced forex trading ichimoku trading strategy explained"

Post a Comment