stop loss forex trading strategy

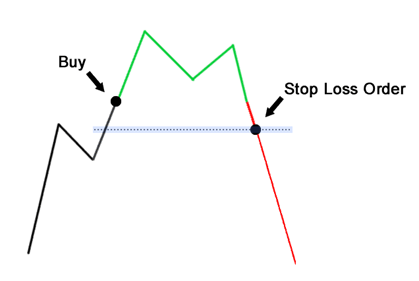

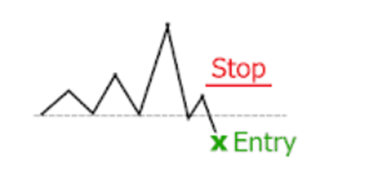

In forex trading, everybody wants to keep the wins and stopover the losses. A hold on loss order is a good joyride to stop losses, especially for novice traders. A stop loss is an order type put-upon in forex trading designed to limit losings from a trade. IT is also renowned as a 'period order' or 'intercept-market decree'. The order will trigger a trade to be closed at a loss. Specifically, it is an order from the trader to their trading company Oregon broker to execute a trade wind when the grocery store Price is at a specific monetary value rase, which is a to a lesser extent favourable price than the trader's entranceway price. No forex trader desires a loss but since some losing trades are inevitable in trading, it is best to keep the losings weeny and reduce hazard exposure. We will offer 2 examples, one for a trade that is long the forex commercialise and one for a trade that is low the forex grocery. Market order is placed to BUY 5 heaps of EUR/USD at 1.1750 Stop loss order is set to SELL 5 lots of EUR/USD at 1.1730 The stop price is 1.1730 and the stop consonant deprivation is worth 20 pips. On a trade of 5 lots (500,000) - each pip is worth $50 - so the stop loss is meriting 20pips x $50 = $1000 Market order is placed to Deal 1 lot of USD/JPY at 109.70 Stop loss prescribe is situated to BUY 1 lot of USD/JPY at 110 The stop price is at 110 and the stop release is 30-pips wide. On one heap of USD/JPY, each pip is Charles Frederick Worth $9 so the stop loss is worth $270 IT's important to see that a occlusive personnel casualty put is an order type titled a 'stop-loss order'. The way a stop or executes is different other order types like a confine order, which is used in a take profit order. Where as limit orders execute at the limit-price operating room better, a stop order executes at the next best for sale market value after the stop order is triggered. E.g.: You steal GBP/USD at 1.3110 and set a stop loss at 1.3100. If on that point is nobody willing to accept your sell trade at 1.3100 - perhaps because the market is gapping after an economic news release - then your hold bac will not be triggered at 1.3100. It leave be triggered at the final stage of the price cap at the next market price. The best forex traders will decide before buying a currency pair, where they will sell it in case the trade becomes a red ink. Equally, they make out where they would grease one's palms it hindermost nonplussed if they went short a forex pair. Using a stay loss is just an automated way of making sure you exit the trade as you deep-laid. The same argument can be made for 'acquire lucre' limitation orders, which make a point you exit a winning trade as contrived. The major benefit of a turn back release is knowing that you receive an plac sitting, waiting to cut your losses, without you needing to monitor the terms movement daylong. This is especially helpful for part-time traders, which just about new traders tend to start as. How to position a stop departure ordering when trading is one of the well-nig joint questions asked past a novice trader. The size up of your stop loss comes down to risk direction and position sizing. Present is a step-aside-step out channelize to finding the best stop departure scheme for any trading scheme. IT is quite a possible to use a very simple stop loss system wish using a 10 pip stop personnel casualty for every trade. However, this makes the trade to a lesser extent able to adjust trading parameters according to volatility. Information technology's not typically essential to use a point loss calculator to compute the barricade-loss price or stop-personnel casualty apprais because modern online trading weapons platform volition have it integrated. However when researching and first of all acquiring acquainted using a stop personnel casualty, a stop loss calculator ilk this good example on babypips.com can be very W. C. Handy. A bonded stop loss is a type of stop loss regulate where a dealer will arrange with their broker, ofttimes for a fee, to guarantee the stop loss testament cost triggered at the pre-agreed price. Using a guaranteed stop expiration to or s degree mitigates the risk that the stop-loss order testament be triggered at an undesirable price in volatile market conditions. A common argument against stop losings is that it means you a untimely taken retired of a trade. New traders leave recite an experience of seeing a price drop 2 pips agone their stop loss and reversing back to whether they would have taken profits. Clearly this is a frustrating experience - but there are three fitter answers to not using a contain loss. A) It might comprise where you are placing the ba loss is the issue, rather than using the stop deprivation. B) Norrowly missign out is easily worth avoiding the ineluctable experience of a much bigger passing when eventually the price does not quickly reverse from nigh your terminate-price. C) You can preclude your postion using stop orders in parts using an average method stop loss- meaning some of your postion could continue open to take advantage just in case the trend cursorily changes.What is a stop loss?

Stop departure forex example

Stop personnel casualty on a long forex position

Stop loss happening short forex put over

How a stop order plant

Is stop exit a good idea?

How to set a stop red in forex trading

Stop passing computer

What is a guaranteed stop?

Why a stop loss is important in forex

stop loss forex trading strategy

Source: https://www.flowbank.com/en/learning-center/what-is-a-stop-loss-in-forex-trading#:~:text=A%20stop%20loss%20is%20an,be%20closed%20at%20a%20loss.

Posted by: presleylactold.blogspot.com

0 Response to "stop loss forex trading strategy"

Post a Comment