Best Forex Pairs To Trade For Beginners

What are the Best Currency Pairs to Merchandise?

That's a question that every forex trader will have asked themselves many times and they will likely practise then again throughout their trading journeying. The reason for that is that equally with so many things in the financial markets in that location is no definitive reply to this question, or at least, not a perpetual one.

After all, markets are dynamic, that is ever-changing and so is the list of the best instruments to merchandise, what works for traders today may non be appropriate in three or half-dozen months.

That said, there are some basis rules we can look at that will have us some way towards answering the question above.

The best currency pairs for near traders to merchandise are those with good round the clock liquidity that are liable to tendency. That is the price following a particular direction for a fixed menstruation of time.

The more illiquid currencies whose prices motion erratically are less desirable, though some active short-term specialist traders known as scalpers can prefer this blazon of instrument.

For nigh of us though liquidity is the determining factor. The most liquid of all FX pairs is the Euro versus the US dollar (EURUSD). The British pound against the US Dollar (GBPUSD)

The US Dollar versus the Japanese Yen (USDJPY) and the Australian Dollar versus its U.s. counterpart (AUDUSD) are all very popular and widely traded FOREX pairs.

What are the best currency pairs to trade at dark?

FX markets operate 24 hours a mean solar day v days a week they are truly global trading starts in Asia moves beyond the Middle East and into Europe and London in particular and then onto New York and the United states of america so, night time trading for those based in Europe might be the early evening when the New York session is underway just the London session has airtight. Traders operating at night time are unlikely to notice as well much of a deviation.

However, we should admit that in one case London has shut up shop for the twenty-four hour period in that location will be fewer market participants, that'southward offset to some extent by the fact that many of the biggest players in the FX markets are the major American banks.

Mostly, though, markets tin can get less liquid afterwards the U.s. shut into the Asian open.

In short trading in the liquid majors is likely the best strategy, though as nosotros saw back in Jan 2019, with the flash crash in the Japanese yen. Fifty-fifty one of the near widely traded currencies can suffer from limited liquidity out of hours, which in this example was exacerbated by an extended New Year's vacation in Japan.

Near anticipated currency pairs

Predictability is not something that is often associated with the FX markets there are currencies which are pegged to a criterion such equally the US Dollar or indeed to a basket of other currencies, the most famous currency peg of recent times was that of the Swiss franc to the euro. Under which the Swiss national bank sought to limit the appreciation of the Swiss currency to maintain the competitiveness of Swiss exports. Nevertheless despite imposing negative involvement rates and selling their own currency, the Key bank was unable to stalk the flow of funds moving into the franc, and famously in Jan 2015, the SNB pulled the plug letting the franc notice its own level against the Euro.

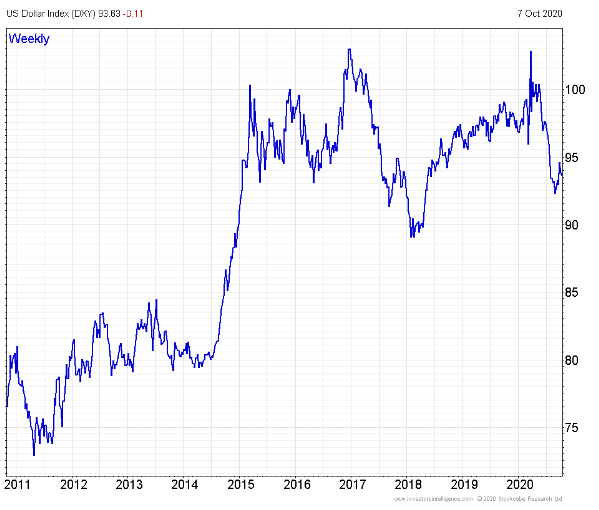

The instrument that has had one of the strongest long-term trends over the last 8 years is not a currency pair but rather a trade-weighted basket. That is a currency compared to the operation of the currencies of its major trading partners, In this instance, the dollar index.

Source Investors Intelligence

The dollar alphabetize had trended college since early 2011 withal it peaked in March 2020 and sold off every bit COVID-19 disrupted the US and global economies the full furnishings of which are notwithstanding playing out

The virtually traded currency pairs 2020

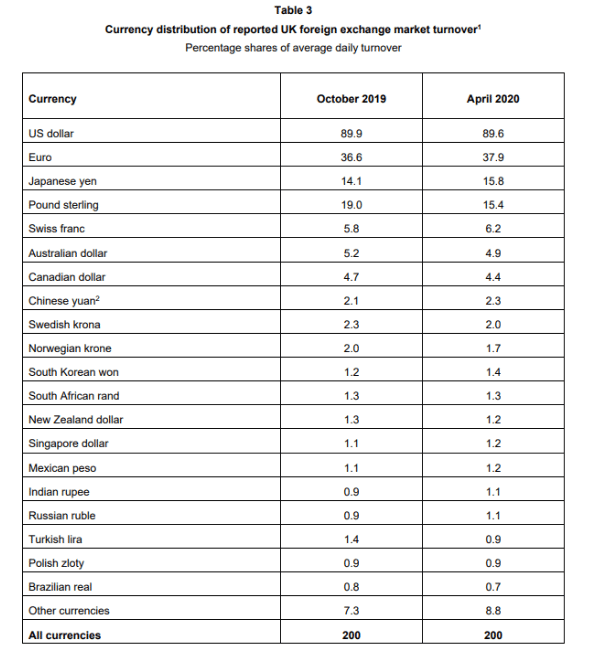

There is no fundamental commutation or counterparty in FX markets and detailed book figures are published sporadically at best and even so, not necessarily by all participants. However, nosotros tin can get a good idea most which were the near traded currencies in a given twelvemonth thanks to surveys conducted by the Banking concern of England among the major FX players in London. Which is the largest FX market place in the globe. The table below is fatigued from merely such a survey, that was conducted during April 2020 the table shows the pct of average daily turnover by currency in both October 2019 and April 2020 nosotros tin can see that the dollar was involved in around 89.half-dozen% of transactions, the Euro in just over 37% and both the British pound and Japanese yen in around fifteen.5% each, during early on 2020

Source the Banking company of England semi-annual FX survey Apr 2020

The meridian ten FX pairs past volume traded and news flow

| No. | Symbol | FX Pair |

| 1 | EUR/USD | Euro vs US Dollar |

| 2 | GBP/USD | British pound vs US dollar |

| 3 | USD/JPY | US Dollar vs Japanese Yen |

| 4 | EUR/GBP | Euro vs British Pound |

| 5 | AUD/USD | Australian Dollar vs US Dollar |

| 6 | USD/CAD | U.s.a. Dollar vs Canadian Dollar |

| 7 | USD/CHF | US Dollar vs Swiss Franc |

| 8 | NZD/USD | NZ Dollar vs U.s.a. Dollar |

| 9 | EUR/JPY | Euro vs Japanese Yen |

| 10 | EUR/AUD | Euro vs Australian Dollar |

Source Good Money Guide Research

Which are the best brokers to trade Forex pairs with?

Equally with all trading, you lot need a decent broker if you are going to stand half a chance at successful forex trading. You lot can compare the best forex brokers here or read adept and client reviews of these popular brokers for forex trading below;

- IG review

- CMC Markets

- Saxo Capital Markets review

Related Guide: Here are 8 tips to remember when trading currency pairs.

What are Currency Pairs?

Currency pairs are classically defined as exchange rates that include the US Dollar as one of their components. However, since the launch of the Euro or European unmarried currency, the definition has been extended to include FX rates that include the Euro (Other FX rates that don't contain the Euro or the dollar are known every bit crosses).

FX pairs are delineated by a combination of two, three-letter mnemonics or codes.

For example, USDJPY 105.75 is the notation for the dollar-yen charge per unit.

These currency rates are known equally FX pairs because they consist of two elements, which are known as the base of operations currency and the quote currency.

Base currency

The base currency is the start-named currency, in the above example, the US dollar, USD.

Quote currency

The quote currency is the second named currency which in this instance is the Japanese yen, JPY.

FX rates are merely an expression of the comparative worth of 2 currencies and the figures 105.75 tell us that it takes 105.75 yen to be able to buy 1 United states of america Dollar.

Are Major Forex Pairs the all-time to Merchandise?

FX rates are further categorised every bit being either major or minor pairs or crosses, the stardom betwixt these 2 groups is based on the size of their respective underlying economies and the level of turnover in that currency within the FX markets. FX majors represent those currencies from the world'southward largest economies, and which take a high turnover in FX markets. The minors are currencies from smaller economies which are less actively traded.

FX majors are generally more than liquid and well researched and there is usually enough of information and news flow to continue traders active in them. Against that FX majors tend to be widely followed and tin exist crowded places to trade. Given their popularity, it can be hard for private traders to find an edge.

Minors, on the other hand, are often less liquid and non so well researched or popular, that ways that information technology may be easier for traders to detect an edge or advantage in the minors.

However, it may non exist as easy to enter or go out trades in the minors, particularly in sessions that are well away from their home markets.

What were the all-time forex pairs to have traded in 2020?

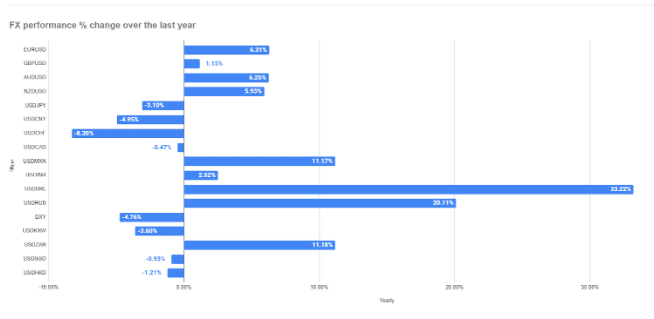

The simplest fashion to answer this question is to look at the performance of actively traded currencies throughout 2020 year to date. In doing that we presently find that the Euro was pretty ascendant over the year to engagement making strong gains against pretty much everything autonomously from the Swedish and Danish krona and the Swiss franc. The trade-weighted Euro or Euro index gained +4.3% betwixt January and mid-october 2020

Currencies that gained vs the USD

The Euro gained more than 6.3% confronting the Us dollar over the 52 weeks to mid October 2020 however those gains were eclipsed by the Swiss franc against which the US currency savage by 8.30% the franc'due south safe haven status coming to the fore once again. The Australian dollar has too performed well versus the greenback gaining +half dozen.25% since October 2019. While near neighbour the Mexican peso posted double digit gains of +11.17% against the dollar.

Source Good Money Guide Research

Currencies that dropped vs the USD

The weakest performers, those making the biggest losses confronting the dollar over the last year, were the Indian Rupee lower by -2.52% the South African rand which lost -eleven.18% and the rouble that brutal by just over -20% when compared to the dollar'.

The best forex pairs to trade in 2020/21

The best pairs to trade in 2020/2021 or indeed at whatsoever time are likely to be those that reflect what is going on in the world currently, both economically and politically.

The pace of recovery in the global economic system following the global pandemic is the key issue, that suggests that commodity currencies and those linked to trade are likely to be active as the recovery either gathers pace or fizzles out. The performance of the Greenback is probable to be influenced by both the path of the Coronavirus and the US elections.

Trading market place sentiment

The good news for currency traders is that certain FX rates have become synonymous with particular economic and political influences, for example, the AUDUSD is sensitive to changes in sentiment around global trade. Australia is a large trading partner of China and the USA.

By the same token, as we saw in 2018 the Due south African Rand is sensitive to issues that touch on emerging markets. Such as changes in commodity prices and or sentiment towards them. This can bear witness up in its exchange rates particularly against the U.s.a. dollar (in which near bolt are priced) dollar rand has the ticker USDZAR.

Sterling exchange rates, against both the Euro and the US dollar reflect the markets thinking on Brexit and the prospects for the Great britain economy thereafter. While USDJPY or dollar-yen is seen as a safe haven and the yen often strengthens when markets are in a take a chance-off mood, that can be caused by heightened political tensions or economic uncertainty, both of which the markets dislike.

In terms of FX operation year to date the tabular array beneath shows us the returns of selected pairs and crosses in 2020 thus far.

Here's where you can compare spread betting brokers for forex trading.

| Ticker | Name | YTD % Change |

| EURGBP | Euro/Pounds Sterling | +7.3% |

| CHFUSD | Swiss Franc/US Dollar | +5.vii% |

| EURUSD | Euro/U.s.a. Dollar | +iv.8% |

| CNYUSD | Chinese Yuan/US Dollar | +iii.2% |

| CHFJPY | Swiss Franc/Japanese Yen | +2.5% |

| AUDUSD | Australian Dollar/The states Dollar | +2.one% |

| USDZAR | USD/S African Rand | +17.half-dozen% |

| EURJPY | Euro/Japanese Yen | +1.6% |

| USDKRW | US Dollar/South Korean Won | -0.80% |

| EURCHF | Euro/Swiss Franc | -0.90% |

| AUDJPY | Australian Dollar/Japanese Yen | -0.90% |

| CADUSD | Canadian Dollar/United states Dollar | -1.xx% |

| GBPUSD | British Pound/United states Dollar | -two.forty% |

| DXY | Us Dollar Alphabetize | -3.00% |

| USDJPY | US$/Japanese Yen | -3.00% |

| GBPJPY | GBP/Japanese Yen | -5.forty% |

| GBPCHF | GBP/Swiss Franc | -8.00% |

| TRYUSD | New Turkish Lira/The states Dollar | -25.00% |

| BRLUSD | Brazilian Existent/US Dollar | -27.xc% |

Source Investors Intelligence

Which is the best currency to trade right now?

Again, information technology very much depends on what you lot are looking for only if you lot are looking for volatility and trading opportunities that this can create then the pound sterling is probably your best bet.

The political situation in the UK seems to shift almost every solar day with the pound weakening on heightened prospects for a no-deal Brexit and rallying if news breaks that make a hell-raising Brexit less likely. That said economical problems in the European union and the potential for a new occupant in the White Business firm mean that both the dollar and the euro are also likely to remain centre stage until the twelvemonth-terminate.

Which currency pair is almost assisting in forex?

This is not something that has a single quantifiable answer, after all, profitability is likely to be highly variable from trader to trader and will depend on other factors such equally time scales, the frequency of trading, risk-reward ratios and the amount of leverage employed.

What's more than, if we view FX trading as essentially a zero-sum game, that is 1 with a buyer for every seller and a seller for every heir-apparent. Then information technology follows that for every winner in that location must also be a loser. If I trade against you and I brand a profit, so logically you must make a loss and vice versa.

In those circumstances, the concept of the "most profitable pair" doesn't really make any sense. What can say yet is what is the most actively traded currency pair and that is EURUSD. Which according to data from the BIS (the central bank's banker) turns over some i.59 trillion dollars per day on average, almost fifty per cent more the yen and double the daily turnover of the pound in dollar terms. By comparison, the total daily turnover in FX markets averaged just over 5 trillion dollars according to the BIS 2016 information.

The best currency to invest in 2020?

Investing in a currency implies a long-time horizon and ownership of the underlying assets these characteristics are non usually associated with the short-term margin trading of FX pairs.

To invest in a currency, you would probably want to consider a deliverable transaction where y'all take buying of the underlying currency of your selection. Alternatively, you tin purchase avails denominated in the currency you wish to invest in and proceeds exposure to the currency in that style.

For example, if you are an Australian investor with Australian dollars and you buy European shares denominated in Euros you have exposure to both the underlying and the euro Aussie dollar substitution rate or EURAUD charge per unit. You tin too try to exploit long-standing relationships betwixt stock indices/equities and national currencies. For example, both Dax 30 and the FTSE 100 indices are full of exporters whose share prices often do good as the pound or the euro weaken and vice versa. Of course, it is ever a proficient thought to seek professional advice before making an investment to establish that they are suitable for your circumstances and appropriate to your needs.

Source: https://goodmoneyguide.com/top-ten-forex-pairs-trading/

Posted by: presleylactold.blogspot.com

> Forex Brokers >

> Forex Brokers >

0 Response to "Best Forex Pairs To Trade For Beginners"

Post a Comment